With its coconut trees, lovely beaches, sunshine, golf courses, and no state income tax, it’s hardly surprising that many people want to move to Florida. But what kind of home loan programs are available to you when looking to buy a house in the Sunshine State?

This blog post will review several loan programs and explain their offers. We will also provide you with a few tips on how to qualify for these loans. Whether you are a first-time homebuyer, veteran, or looking for some help with your down payment, we’ve got something for you.

What Home Loan Programs Are There in Florida?

Florida’s most popular home loan programs include FHA, VA, and conventional mortgages.

FHA loans are government-backed loans available to first-time homebuyers and those who have already owned a home. These loans tend to have lower interest rates and down payments than other types of loans, making them an excellent option for those looking to save money.

Additionally, FHA loans can be used to purchase various types of property, including single-family homes, condos, and even manufactured homes. However, they cannot be used to purchase a non-primary residence property.

VA loans are another government-backed loan, but they are only available to veterans, active duty military members, and their surviving spouses. These loans come with low-interest rates and no down payment and mortgage insurance requirements.

Conventional mortgages are not backed by the government and are only available through private lenders. These loans typically require a higher down payment than other types but can often offer lower interest rates.

Are Loan Programs Available to a Florida First-Time Homebuyer?

A first-time buyer is someone who has not owned a primary residence for three years, a single individual who has only owned a home with their spouse, an individual who has only owned a property that was not permanently attached to the foundation, or an individual who has only owned an unpermitted structure.

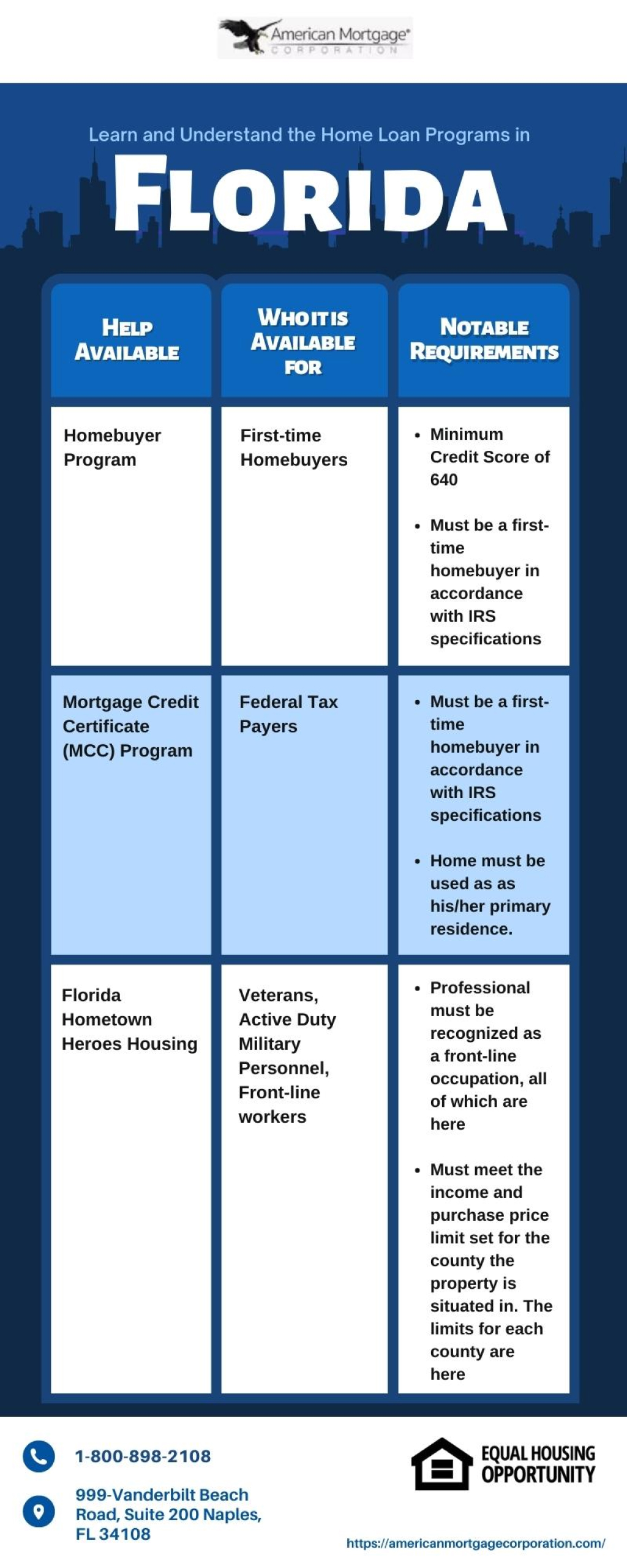

The Florida Housing Finance Corporation, also known as Florida Housing, is an agency established by the Florida state legislature. It administers several loan programs to assist homebuyers like you in purchasing your first house. Fixed-rate loans and down payment or closing cost assistance are among the programs available.

The Homebuyer Programs are a set of mortgage programs that provide first-time homebuyers in Florida with fixed-rate mortgages for up to 30 years from a network of collaborating lenders and financial institutions.

The company provides FHA, VA, USDA, and conventional loans (Fannie Mae and Freddie Mac). The buildings you can purchase with their homebuyer programs are:

- Single-family homes

- Townhomes

- 2-4 unit homes (of which you must reside in one unit)

- Approved condo projects

- Mobile homes

Also, there will be no waiting list for your transaction to be processed because Florida Housing never runs out of money.

So how do you qualify?

- First of all, you must qualify as a first-time homebuyer in the IRS books, which you can check here.

- You must have a minimum credit score of 640.

- You must complete an approved homebuyer education course.

- You need an income and a purchase price within the county limits you wish to buy in.

Assistance for Florida Tax Payers

Florida taxpayers would be pretty interested in the Mortgage Credit Certificate program. The MCC programs assist first-time homebuyers in saving money each year they reside in their new home.

Technically, the MCC program is not a loan; instead, it allows you to save more each year by claiming a dollar-for-dollar reduction in yearly income taxes, lowering the amount of federal taxes paid.

On their IRS tax return, customers may claim between 10% and 50% of their mortgage interest as a federal tax credit which they can deduct from their taxes.

The credit cannot exceed $2,000 yearly. If some mortgage interest is not added to the tax reduction, this amount can still be deducted from the taxpayer’s tax return.

Note that the MCC Program is not available for conventional loans, and the Florida Housing Corporation no longer provides it. Nonetheless, it still might be made available by local financing agencies.

Assistance for Florida Veterans

Florida has a specially tailored loan offering for you if you are a veteran or an active duty military personnel. This program was previously called the “Salute Our Soldiers Program“ and has now been incorporated into the Florida Hometown Heroes Housing Program. It is, however, not uncommon to see it being referred to by its more popular name.

The Hometown Heroes Program enables eligible veterans to receive lower than market rates on an FHA, VA, and Conventional mortgage. It also reduces upfront fees and helps with closing costs and down payment assistance.

What Florida Down Payment Assistance Is Available?

Florida Housing down payment assistance is another help available to homebuyers in Florida. However, you can only use these programs with a Florida Housing loan program.

The FL Assist is one of the down payment assistance programs offered by Florida Housing. It gives borrowers up to $10,000 on VA, USDA, FHA, and Conventional loans at a 0% amortization rate. The FL Assist cannot be forgiven, but the repayment can be put-off until the mortgagor no longer occupies the property. At such a period, the assistance becomes fully payable.

Another program, the HFA Grants, provides eligible borrowers with 3% to 5% of the house’s purchase price for closing costs and down payments. After five years, this second mortgage is forgiven at a rate of 20% per year.

Another loan program that offers buyers up to $10,000 in assistance is the Florida Homeownership Loan. It is a second mortgage given at a 3% interest rate. It must be paid off in 15 years unless you refinance, move, sell, or otherwise transfer the title of the building. In such situations, the remaining amount must be fully paid.

Frequently Asked Questions

What Home Loan Programs Are Available for Low-Income People in Florida?

Low-income people looking to purchase a home in Florida would be well served by opting for home ownership programs that Florida Housing Corporation finances. Not only do they offer FHA, VA, and USDA loan options at low-interest rates, but they can also contribute towards helping you get some much-needed cash towards funding your down payment and closing costs.

How to Apply for an FHA Loan in Florida?

To obtain an FHA loan, you must first locate a lender with acceptable rates. Then you may begin your application online. Alternatively, for more assistance, talk with a loan officer one-on-one.

How to Qualify for an FHA Loan in Florida?

To qualify for FHA loans in Florida, your credit score must be 580 or higher. This would ensure that you would only be required to pay 3.5% of the purchase price as a down payment. Anything lower, you’ll have to pay up to 10%.

It would help if you also had full-time employment dating back at least 2 years.

What Are Some Home Loan Programs Offered in Florida?

Florida’s unique home loan programs are the Florida HFA Preferred Conventional Loan, Florida HFA Preferred 3% Plus Conventional Loan, Florida Hometown Heroes Housing, and FL Assist.

What Types of Loans Can You Get When Buying a Home in Florida?

You can get FHA, VA, and USDA loans when buying a home in Florida.

What Are Some Benefits of Getting a Home Loan in Florida?

Some benefits of a home loan in Florida are that you can get low-interest rates, down payment and closing cost assistance, and access to special programs, mainly if you are a veteran or a frontline worker.

What Steps Should People Take When Applying for a Home Loan in Florida?

When applying for a home loan, people should ensure that their credit score is high enough, that they have full-time employment, and that they make the most of the loan options available. They should also look into down payment and closing cost assistance programs.

What Are Some Common Home Loan Programs You See That People Can Apply For?

Florida’s standard home loan programs are FHA, VA, and USDA. You can also get assistance with your down payment or closing costs through programs like the FL Assist or the HFA Preferred Grants.

How Do You Choose the Right Lender for a Home Loan?

When choosing a lender for your home loan, you should compare interest rates, fees, and loan terms. You should also ensure that the lender is reputable and has a good track record.

What Advice Can You Give to Help First-Time Home Buyers?

Some advice that can help first-time home buyers is to improve your credit score, save up for a down payment, get pre-approved for a loan, shop around for the best interest rates, and to take advantage of programs like the MCC, FL Assist, or the HFA Preferred Grants.

What Would You Suggest If You Have to Pick Between a Fixed and a Variable Home Loan?

A variable home loan might allow you to pay lesser fees at the beginning and sometimes during the mortgage length when interest rates are low. However, this can be unpredictable, and if interest rates rise, you might have to make much higher monthly payments.

So, if you have to pick between a fixed and a variable home loan, it’s better to go with a fixed home loan. This will give you the peace of mind of knowing exactly what your payments will be each month, and it can also help you budget better.

What Are the Best Loans in the State of Florida?

The best loan in the state of Florida is the Florida Hometown Heroes Housing. This is because it makes housing affordable for front-line workers who are sometimes on a low income. The FL Assist too is a good option as it allows homebuyers to have enough money to use as a down payment and get their desired home.

What Are Some of the Requirements to Qualify for a Home Loan?

To qualify for a home loan in Florida, you must have a credit score of at least 640. You are also required to take an accredited home buyer education course. The house associated with the loan must also be situated in Florida, and your purchase price and income must be below the limits for the county you are purchasing in. Also, You can only use the loan to purchase a primary residence.

While it is not compulsory to be a veteran or active duty military personnel, being a first-line community worker does help your chances of getting on board the Hometown Heroes loan program. You can check your eligibility here.

Can You Help Me Find a Home Loan in Florida?

Yes, we can help you find a home loan in Florida. We will work with you to determine what type of loan is best for your situation and then help you find a lender who can provide you with the loan.

Conclusion

There are many Florida home loan programs available to help people purchase a house in the Sunshine State. The home loans in Florida vary in terms of the type of assistance they offer, and some are specifically tailored for veterans or first-time homebuyers. There are also down payment assistance programs available, which can provide borrowers with a substantial sum toward their new home.

So, whether you’re looking for a conventional or government-backed mortgage, there’s likely a program that will fit your needs. Contact us today on Facebook, Twitter, and LinkedIn to learn more about these programs and how we can help you secure financing to buy your dream home in Florida!